Estimated Tax Due Dates 2025 For Corporations Meaning

Estimated Tax Due Dates 2025 For Corporations Meaning. Stay compliant with tax obligations in may 2025. April 15 is commonly considered tax day.

For “regular” corporations (i.e., c corporations) that operate on a calendar year, their federal income tax return for the 2025 tax year is due on april 15, 2025. Individuals, sole proprietors, and c companies must file taxes on that day.

Payment Is Due By April 15.

For corporations with a fiscal year that ends on june 30th, a special rule defers the due date change, allowing these corporations more time to file.

When Are Estimated Taxes Due In 2025?

The table below shows the payment deadlines for 2025.

Mark Your Calendar For These Deadlines In 2025, Based On.

Images References :

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

Irs Estimated Tax Payment Due Dates 2025 Tove Oralie, Quarter 1, january 1 to march 31: C corporation tax returns will be due the.

Source: vernahorvath.pages.dev

Source: vernahorvath.pages.dev

2025 Federal Estimated Tax Due Dates Berte Melonie, Quarter 1, january 1 to march 31: When are the quarterly estimated tax payment deadlines for 2025?

Source: ronaldjohnson.pages.dev

Source: ronaldjohnson.pages.dev

Important Tax Dates 2025 Fred Joscelin, These are quarterly estimated tax payment deadlines for businesses: In 2025, estimated tax payments are due april 15, june 17, and september 16.

Source: stevenvega.pages.dev

Source: stevenvega.pages.dev

Business Quarterly Taxes Due Dates 2025 Lela Shawna, For “regular” corporations (i.e., c corporations) that operate on a calendar year, their federal income tax return for the 2025 tax year is due on april 15, 2025. Mark your calendar for these deadlines in 2025, based on.

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

Q1 2025 Estimated Tax Due Dates Ronny Cinnamon, Partnership and s corporation tax returns will be due the 15th day of the third month after the end of their fiscal tax year. Quarter 1, january 1 to march 31:

Source: calendar-printables.com

Source: calendar-printables.com

Tax Due Date Calendar 2025 Calendar Printables, Here are the key tax filing dates and deadlines you’ll want to be aware of in 2025: The table below shows the payment deadlines for 2025.

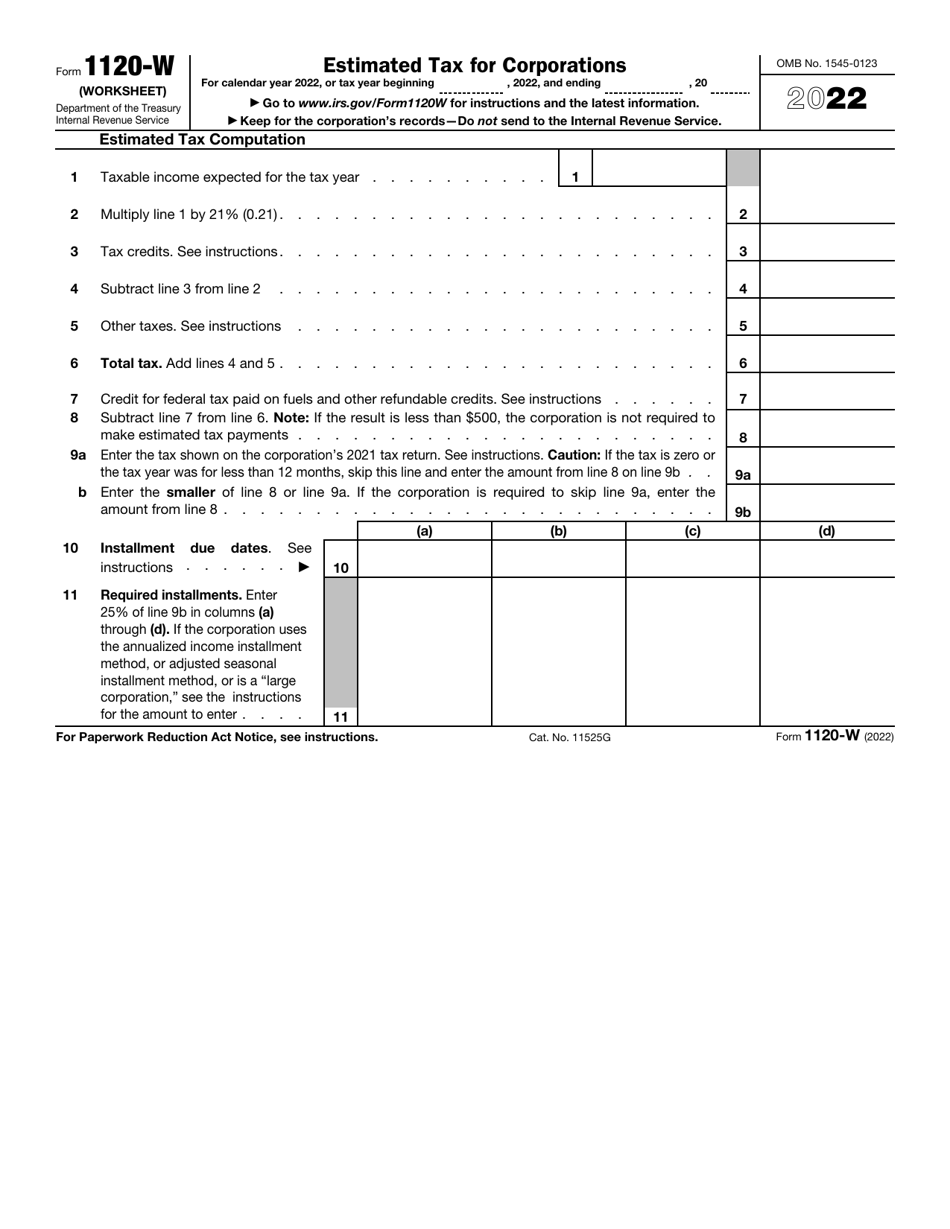

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for, The irs is reminding taxpayers who need to make estimated tax payments that the 2025 second quarter estimated tax deadline is june 17. The table below shows the payment deadlines for 2025.

Source: wallethacks.com

Source: wallethacks.com

Estimated Taxes, Due Dates and Safe Harbor Tax Rules (2025), If you’re a c corporation or llc electing to file your taxes as one for 2025, your corporate tax return is due on april 15th, 2025—unless you. If any due date falls on a.

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Estimated Quarterly Taxes 2025 Due Dates Calendar Shawn Dolorita, Individuals, sole proprietors, and c companies must file taxes on that day. When are the quarterly estimated tax payment deadlines for 2025?

Source: vernahorvath.pages.dev

Source: vernahorvath.pages.dev

Q1 2025 Estimated Tax Due Dates Ronny Cinnamon, Quarter 1, january 1 to march 31: Here are the key tax filing dates and deadlines you’ll want to be aware of in 2025:

If A Corporation Needs To.

In 2025, estimated tax payments are due quarterly according to the following schedule:

Owners Of Sole Proprietorships, Partnerships, And S Corporations Are.

Individuals, sole proprietors, and c companies must file taxes on that day.