Us Income Tax Brackets 2024

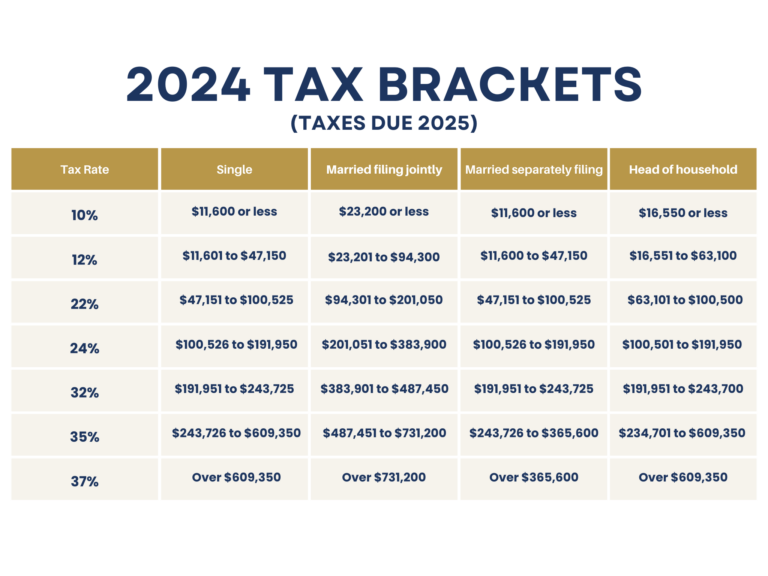

Us Income Tax Brackets 2024. — there are seven federal tax brackets for tax year 2024. — the irs uses 7 brackets to calculate your tax bill based on your income and filing status.

— the tax cuts and jobs act (tcja) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase. — there are seven tax brackets for most ordinary income for the 2023 tax year:

Us Income Tax Brackets 2024 Images References :

Source: mayeyestella.pages.dev

Source: mayeyestella.pages.dev

Standard Deduction 2024 Irs 2024 Olga Tiffie, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: prudiyanderea.pages.dev

Source: prudiyanderea.pages.dev

Us Tax Brackets 2024 Amity Beverie, Based on your annual taxable income and filing status, your tax.

Source: www.aarp.org

Source: www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments, — the irs uses 7 brackets to calculate your tax bill based on your income and filing status.

Source: dodieyconcettina.pages.dev

Source: dodieyconcettina.pages.dev

Us Tax Brackets 2024 Irs Erna Rickie, — for tax year 2024, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%.

Source: www.prioritytaxrelief.com

Source: www.prioritytaxrelief.com

A Guide to the 2024 Federal Tax Brackets Priority Tax Relief, — the internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2024) and the.

Source: janelacamella.pages.dev

Source: janelacamella.pages.dev

Tax Tables 2024 Irs 2024 Sandy Thalia, 2024 us tax tables with 2024 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Source: donnyyluelle.pages.dev

Source: donnyyluelle.pages.dev

Us Tax Brackets 2024 Katha Arliene, — there are seven federal tax brackets for tax year 2024.

Source: bernardisecurities.com

Source: bernardisecurities.com

2024 Brackets and Rates Bernardi Securities, — there are seven federal tax brackets for tax year 2024.

Source: linayanjanette.pages.dev

Source: linayanjanette.pages.dev

Us Tax Brackets 2024 Aimil Penelopa, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: evyybarbaraanne.pages.dev

Source: evyybarbaraanne.pages.dev

Irs Tax Brackets 2024 Explained Lola Sibbie, — for example, if you’re required to withdraw $100,000 or more annually to cover living expenses, this amount will be added to your taxable income, potentially.

Posted in 2024